‘Let Them Eat Cake’

March 27, 2018

(This article first appeared in the March-April 2018 issue of the American Postal Worker magazine)

By President Mark Dimondstein

When the hungry people were demanding bread, French Queen Marie Antoinette was said to utter the words, “Let Them Eat Cake!” Little wonder she lost her head in the ensuing 1789 French revolution.

This statement has remained symbolic of the arrogance of kings, oligarchs, corporate robber barons and Wall Street vultures – and their utter disdain for “common” people.

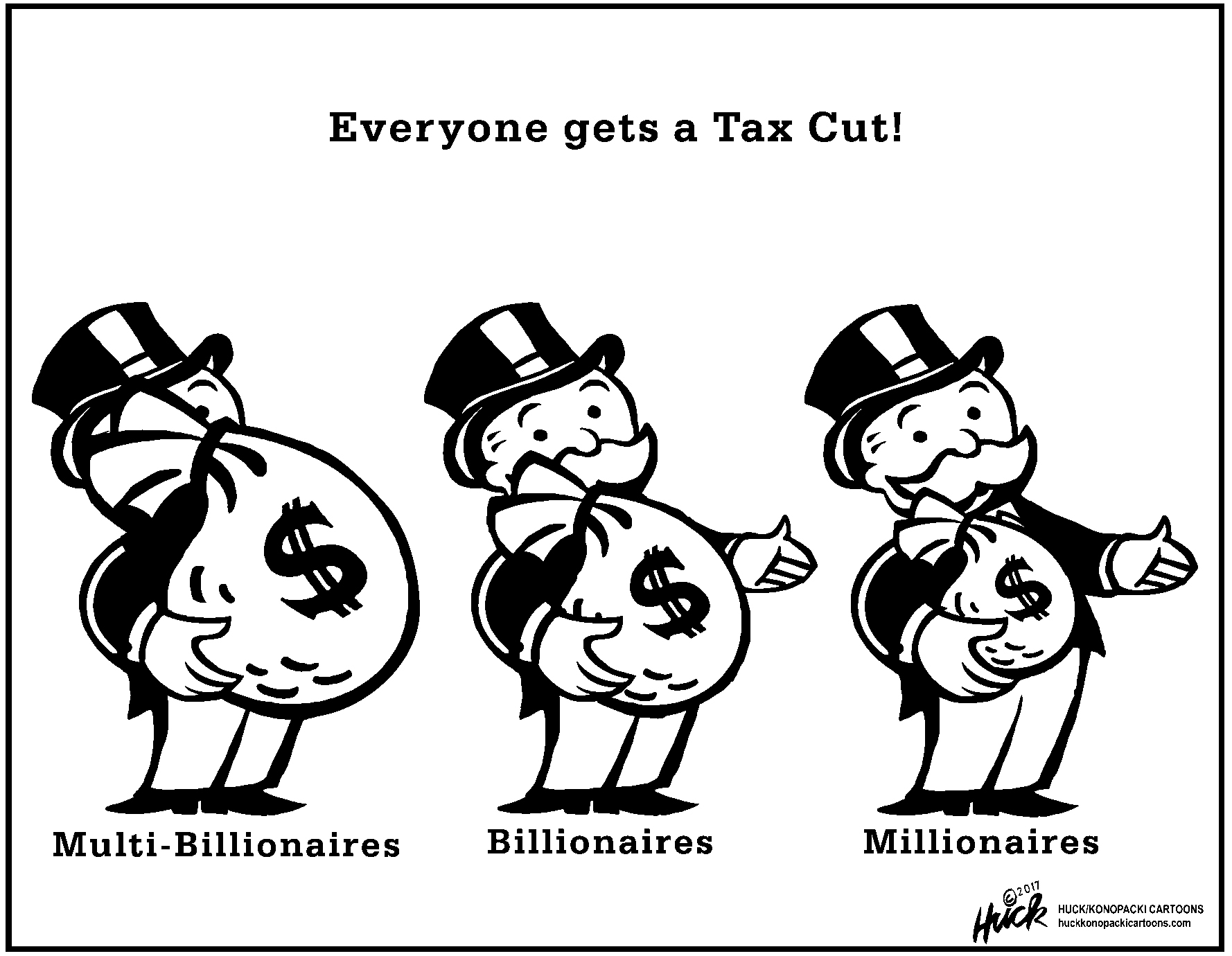

The recent passage of “tax reform” is a “let them eat cake” scam – a huge $1.5 trillion transfer of wealth from working people to corporations and the ultra-rich. It further skews a tax system where the elite already don’t pay their fair share. Whatever temporary small gains may be included for working folks (I am for lower taxes on working people), over the long run most will pay a heavy price with higher taxes, cuts to vital programs such as Medicare and Social Security, fewer investments in our communities, and less public services. These politicians who have added trillions to government “debt” will now target our retirement and other postal worker benefits for cuts.

Whether Republican, Democrat, Independent, Libertarian, Socialist, Conservative or Green, I doubt any APWU member welcomes this outcome. Nor should we stand for this.

Some “lowlights” of the legislation:

- The law permanently lowers maximum taxes on corporate profits from 35% to 21%. Supporters “selling” this hoax claim it will lead to more job creation and higher wages. In reality, the increase in corporate profits (already at record levels) will mainly go to private investors/shareholders, individual bank accounts and trust funds.

- The Congressional “Joint Committee on Taxation” estimates that by 2025, taxes will rise for every group with incomes under $75,000 a year. For those making less than $30,000/year, taxes will rise in four years.

- An analysis by the non-partisan Tax Policy Center predicts that those in the top 20% income level will receive 90% of the legislation’s benefits. The wealthiest 1% will gain around $62,000/year, and for the wealthiest 0.1%, $321,000/year!

- The law widens already obscene income inequality. Imagine, just six Walmart family members have personal wealth equal to the combined wealth of 130 million U.S. people in the lower economic tiers!

- Huge loopholes enabling corporate tax evasion remain. In 2014, General Electric made $14 billion in profits but paid no taxes!

- The $1.5 trillion in corporate tax cuts could have been directed to public works projects rebuilding the country’s crumbling roads, bridges, railways, schools, parks, water/sewer systems and electrical grid – and creating millions of decent jobs.

A jubilant President Trump celebrated his first major legislative achievement, as well he should. Research indicates that he could personally gain an additional $15 million/ year in tax savings. His son-in-law, senior advisor Jared Kushner, may reap $12 million/year.

King Louis XVI and Queen Marie Antoinette won plenty of battles in their day, but the people eventually prevailed, declaring “Down with the king!” Today’s Wall Street rulers won this round. Those who can afford higher taxes will now pay even less, with ever greater tax burdens on workers. Making matters worse, half our tax dollars are diverted to the bloated military industrial complex at the expense of human needs. The system is rigged. It’s high time to take back our country from the rule of the billionaire class. With unions helping to lead the way, let’s mobilize in our millions, from our workplaces and communities, to the halls of Congress and the streets, to reclaim a country “of, by and for the people!”