Spousal Survivor Benefits

January 1, 2018

(This article first appeared in the January-February 2018 issue of the American Postal Worker magazine)

By Retirees Director Nancy Olumekor

We begin a new year with a subject that has generated numerous questions: Spousal Survivor Benefits.

When a retiree receiving Civil Service Retirement System/Federal Employee Retirement System (CSRS/FERS) benefits dies, recurring monthly payments may be made to the surviving spouse if the retiree elected a reduced annuity to provide the benefit. If you are married when you retire, the Office of Personnel Management (OPM) will compute full survivor benefits for your spouse, unless you and your spouse elect a lesser amount or no annuity.

To qualify for the benefits, the surviving spouse must have been married to the retiree for at least nine months. If the death occurs before the ninth month of marriage, a survivor annuity may still be payable if the retiree’s death was accidental, or if a child was born during the marriage.

The survivor benefit election may not be revoked or changed, or another survivor named later than 30 days after the date of the first regular monthly annuity payment to the retiree. Should the marriage terminate before the retiree dies, the amount of annuity will be increased by the the survivor annuity. If the retiree remarries, a selection can be made to provide the new spouse with surivor benefits.

Retirees who are not married at the time of retirement, but marry after, can request that the annuity be changed to include survivor benefits by notifying OPM in writing no later than two years after the marriage.

Survivor claims for death benefits are processed by OPM. To minimize processing delays, the eligible survivor should:

- Promptly notify the bank and request they return any payments received after the date of death to the Treasury Department. OPM cannot authorize a survivor benefit until the Treasury Department informs them there are no outstanding checks payable to the deceased annuitant.

- Notify OPM by completing the form at apps.opm.gov/retire/ death/death.cfm, emailing retire@opm.gov or calling 1-888-767-6738 or 1-724-794-2005.

- Complete the Application for Death Benefits; attach certified copies of the annuitant’s death certificate and any other forms and/or evidence and send to: OPM Retirement Operations Center, Attention: Survivor Processing Section, PO Box 45 Boyers, PA 16017-0045.

Any accrued annuity, unpaid to the be included in the benefits to the eligible survivor. Survivor benefits are effective the day after the retiree dies and continue until the survivor remarries before age 55. The surviving spouse can still receive the annuity if they remarry after age 55.

The surviving spouse and any coverage with your health insurance (FEHBP) only if a survivor annuity was provided, unless the survivor would otherwise be eligible. The premiums will be withheld from monthly survivor payments, provided the premium is less than the monthly survivor annuity.

If you have any additional questions, please contact RetireeQandA@apwu.org.

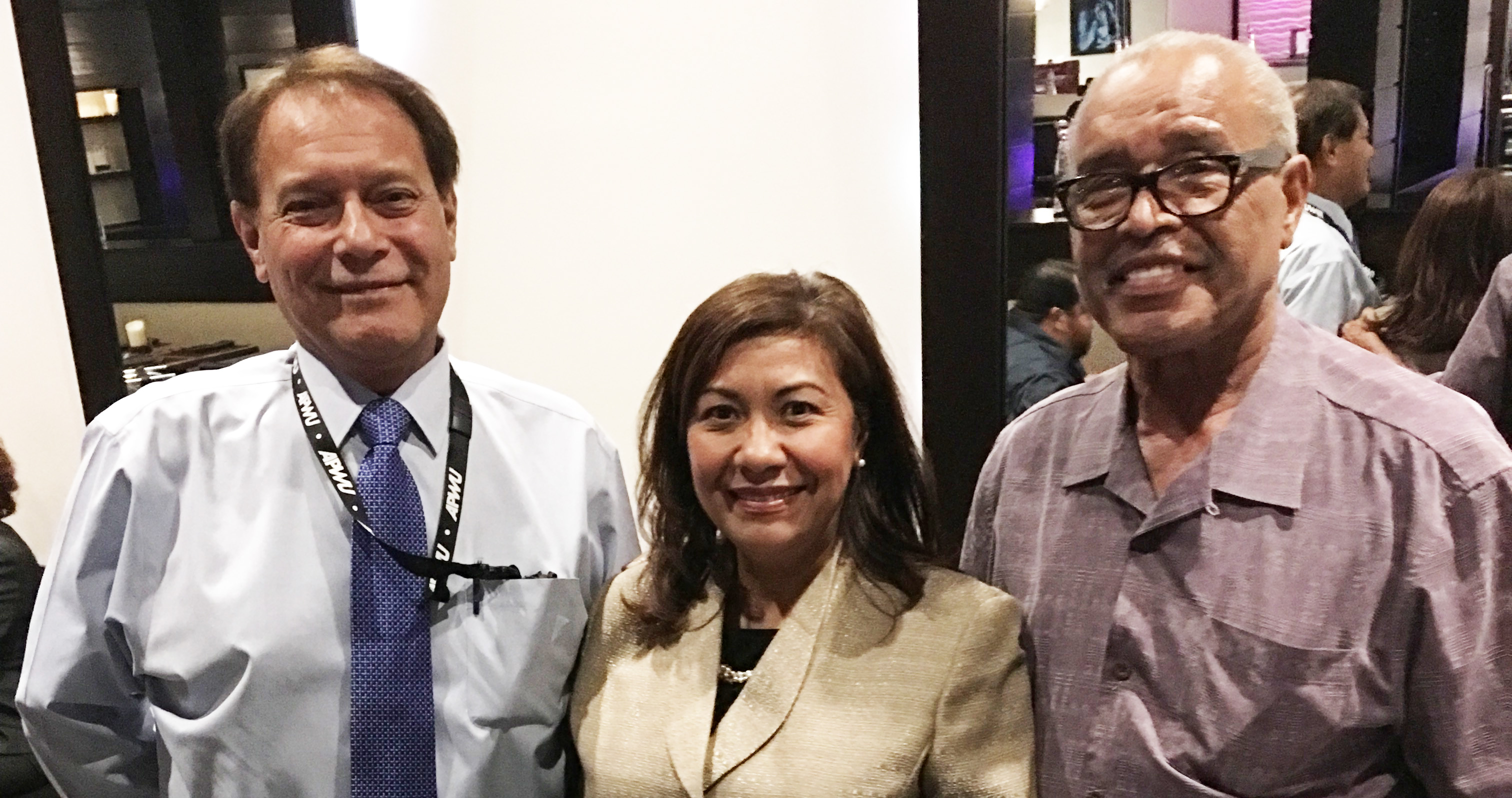

Gordillo, Congresswoman Norma Torres

(D-CA-35) and California Area Local Retiree

Chapter President Roosevelt Daniels.

Retirees in Action

Retirees remain engaged in the political process by holding our congressional representatives accountable and asking them to support issues that protect benefits for retirees, seniors and working families.